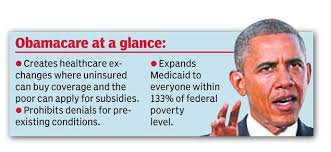

It may be surprising, but Americans overseas may not actually be exempt from Obamacare’s provisions. Obamacare, or the Affordable Care Act, is a new initiative created to ensure that every American has proper health care coverage. There are ‘minimum essential requirements’ that your plan must meet in order to satisfy Obamacare’s provisions and the Act applies to all US citizens, regardless of where they live. So depending on your personal circumstances, you may be required to purchase an acceptable policy. Those who don’t comply are subject to an Obamacare tax on their Federal tax returns. Read more from Costa Rican News

US IRS rules, regulations and laws, for US Citizens, Americans, green card holders, and nonresidents living abroad or moving to the US or out of the US.... valuable information on IRS rules concerning U.S. expatriates and their tax returns, and tax planning.... by an experienced International Tax Attorney

Search This Blog

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment